property purchase tax in france

There are a number of automatic calculators on-line that can be used to obtain an estimate of the fees taxes and other charges for which you will be liable. However there are reduced French TVA rates for certain pharmaceuticals public transport hotels restaurants and tickets to sportingcultural events.

Investment Property Expense List For Taxes Investing Investment Property Being A Landlord

They include agents fees 5-8 notary fees 25-5 stamp duty.

. The notarys fee is one of the biggest bills youll need to pay when you buy a. Step 1. Taxes on goods and services VAT in France.

Choose the region and house you wish to acquire Step 2. French property tax for dummies. The French taxe foncière is an annual property ownership tax which is payable in October every.

The taxe dhabitation is an annual residency tax which is imposed on the individual who is. Property Tax in France Land TaxTaxe foncière. 6500 17000 1627.

Any owner of real estate in France on 1stJanuary of the taxation year must pay the property tax during the last quarter of the same year after receipt of his tax notice. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237. The different options for french property ownership.

Capital gains taxImpôt sur les. When it comes to buying French property foreign nationals are treated on par with citizens of France. Be sure to budget for.

Any person living abroad and owner of real estate in France is subject to French property tax. Individuals resident in France on 1 January of any year and non-residents who have assets in France are taxed on the basis of. Make your offer verbally and via email Step 4.

The whole process should take three or four months from making the offer to signing the final contract. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237. There are two key documents you will sign to buy a property in Francethe Compromis de Vente and the Acte de Vente or Acte Authentique.

The standard TVA rate in France is 20. Taxe sur la valeur ajoutée or TVA VAT in French is a tax on certain goods and services which is included in the sale price. This guide sets out essential information for British nationals wanting to buy a property in France including advice on legal advice fraud residence requirements complaints and more.

Lets take a look at the different fees and taxes involved in a french property purchase. Buying a French Property. Youll also need to pay stamp duty when buying a.

17000 60000 1085. Have a compromis de vente a preliminary agreement which locks both parties into the sale. Notarys fee frais de notaire.

What kinds of sales taxes are there in France when I buy or sell property. Stamp duty is a. The total taxes paid during the house purchase in France may add up 20 to the property price.

Other than their main home French residents pay capital gains tax on worldwide property at 19 plus surtaxes plus social charges which are generally 172 but can be reduced to 75 for Form S1 holders. In total the sum of fees involved in buying the house cant exceed 10 of the propertys value. Calculating Fees and Taxes for Buying Property in France.

Well explain more about that in a minute. Read more about the wealth property tax 3 tax LA TAXE DE 3 The annual 3 tax of the real estate value is imposed when the property in France is acquired by a legal entity and the name of the real owner is kept in secret. The costs involved in buying a property in France generally amount to between 7 and 10 of the value of the house for an older property and about 2 to 3 on a new builds.

They are not always up to date with their rates nor entirely comprehensive but the most reliable one can be found on the. Here is how it is calculated. Stamp duty droit de mutation.

Taxe foncière Land Tax Taxe dhabitation Housing or Residence Tax There are currently reforms underway to abolish the Taxe dHabitation and many French residents will find that they are now exempt from paying it. Foreign nationals are permitted to buy residential and commercial property in France as individuals or through a legal entity. This will be anything from 410.

Additional taxes for property owners and renters. The two main property taxes are. Visit the property preferably with an agent so you dont forget to check anything Step 3.

There is no exemption. Non-residents are liable on French real estate including rights over property situated in France. These are as follows.

It is important to keep all receipts of work done on the property for the capital gains tax but also for the guarantees. Property purchase tax in france.

Pourquoi Faut Il Payer Une Indemnite D Eviction St Tropez France Saint Tropez Day Tours

Taxe D Habitation French Residence Tax

How To Buy A House Or Property In France

12 Step Purchase Process To Buying Property In France

How To Buy A House Or Property In France

We Help You Navigate French Real Estate There Is No Mls In France So We Help You Find Property And Walk You Through The Pro In 2021 France Find Property Estate Agency

Verotuspaatosvaliokunta Aanestys Suosituksista Ajankohtaista Euroopan Parlamentti World Economic Forum Map Europe Map

In Depth Guide To French Property Taxes For Non Residents Expats

St Tropez An Der Cote D Azur Saint Tropez St Tropez France Day Tours

Epingle Sur French Leaseback Purchasing Property In France Lawyer In France

Mexican Real Estate Blog What Is The Trust Deed California Real Estate Real Estate Estates

Wherever You Go Real Estate Holds A Distinctive Role In Shaping Up A Country S Economy Directly Affecting The Buyers And Sellers In The Market There Are Some

House For Sale In Ste Colombe Charente Lovely Location For This 3 Bedroom 2 Bathroom Stone House W French Property Above Ground Swimming Pools Stone House

Pin On French Leaseback French Leaseback Property French Leaseback Resale French Leaseback Mortgage Leaseback Investments In French Residences

French Property Tax Considerations Blevins Franks

The Property Tax Handbook For Brrr Btl Investors By Joshua Tharby The Ultimate Tax And Account Property Tax Accounting Investors

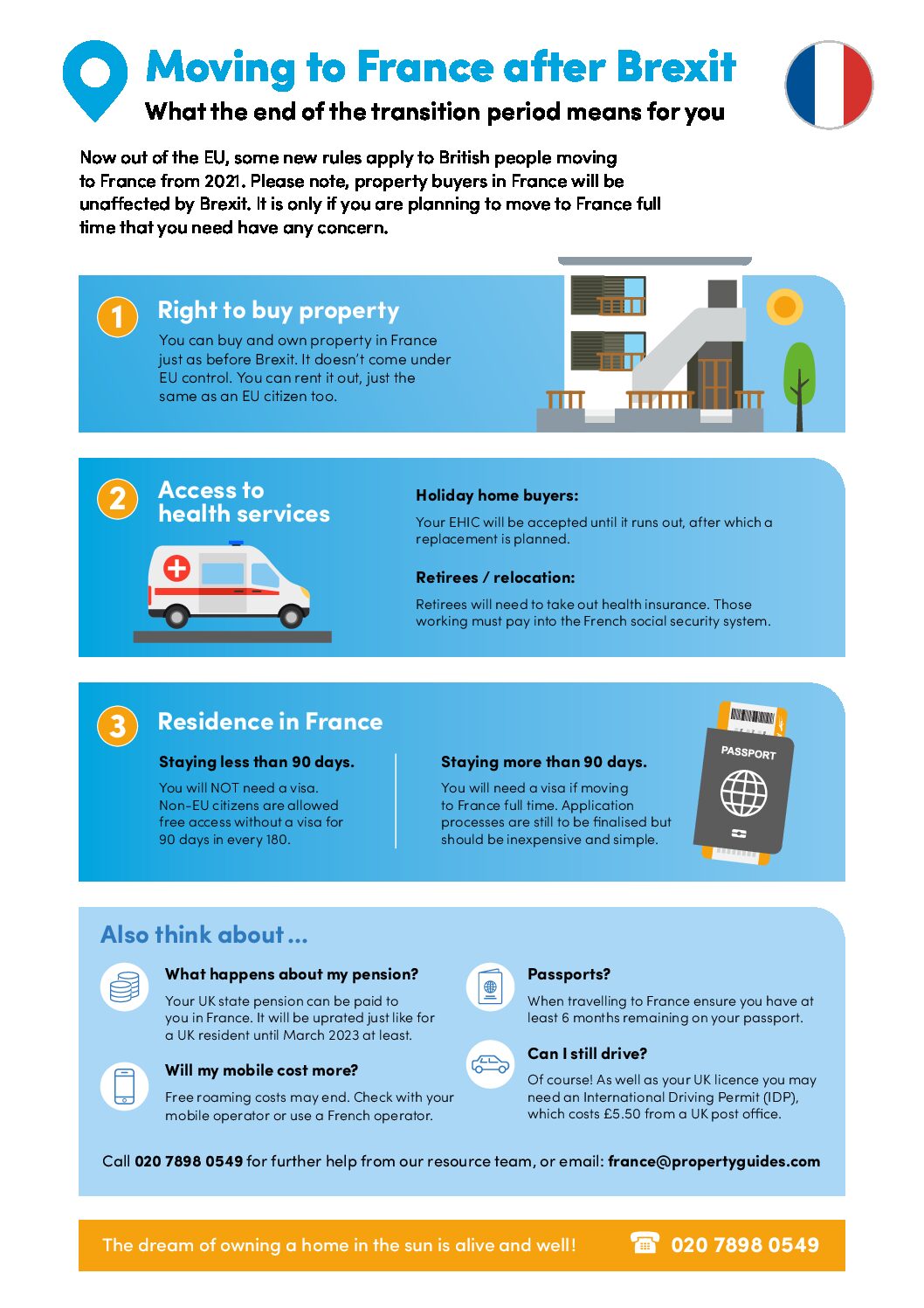

Buying Property In France After Brexit France Property Guides